Category: News

It’s no secret that women’s healthcare has undergone an astounding transformation in just a short time frame. Over the last decade, “femtech” — broadly defined as technologies and services that address women’s health — has shifted from a largely neglected sector to one that has garnered significant momentum among both entrepreneurs and investors. According to Pitchbook, VC funding to femtech startups has grown by nearly 10x since 2012, and Frost & Sullivan estimate that the sector has a market potential of $50B by 2025.

That being said, femtech remains underfunded, representing just 3.3% of total digital health funding in 2019, and 1.5% in the first half of 2020. Part of the problem stems from the relative lack of data about women’s healthcare issues. Until 1993, American women were excluded from clinical trials, and just 4% of all healthcare research dollars today are dedicated toward women’s health issues. The implications for women are stark:

- Women are more likely to die of heart attacks and have a 50% higher chance of misdiagnosis.

- Women account for 75% of patients with autoimmune diseases, and it takes an individual with an autoimmune disease nearly 5 years to get a correct diagnosis.

- Although women report more frequent and severe pain levels, doctors prescribe less pain medication to women than men after surgery.

- Women are more likely to be told their pain is psychosomatic, and their pain is more often treated with sedatives rather than pain medication.

- The US is the only developed country with a rising maternal-mortality rate, doubling from 10.3 per 100,000 births in 1991 to 23.8 in 2014. Worse still, Black women are 3 to 4x more likely to die in childbirth than white women.

It’s clear that the existing healthcare system is failing women. What we need is a wealth of more research, more medical professionals, and more solutions that are specifically designed to address women’s health issues. While no single startup will be able to fix it, a new generation of women-centric healthcare companies is finally seeking to level the playing field, and investors are starting to take notice.

In this first post, I outline the current state of the femtech market and share insights around key trends driving the industry. In my second post, I will highlight three founders in the industry, who are aiming to close the care gap by blazing their own trails.

Funding

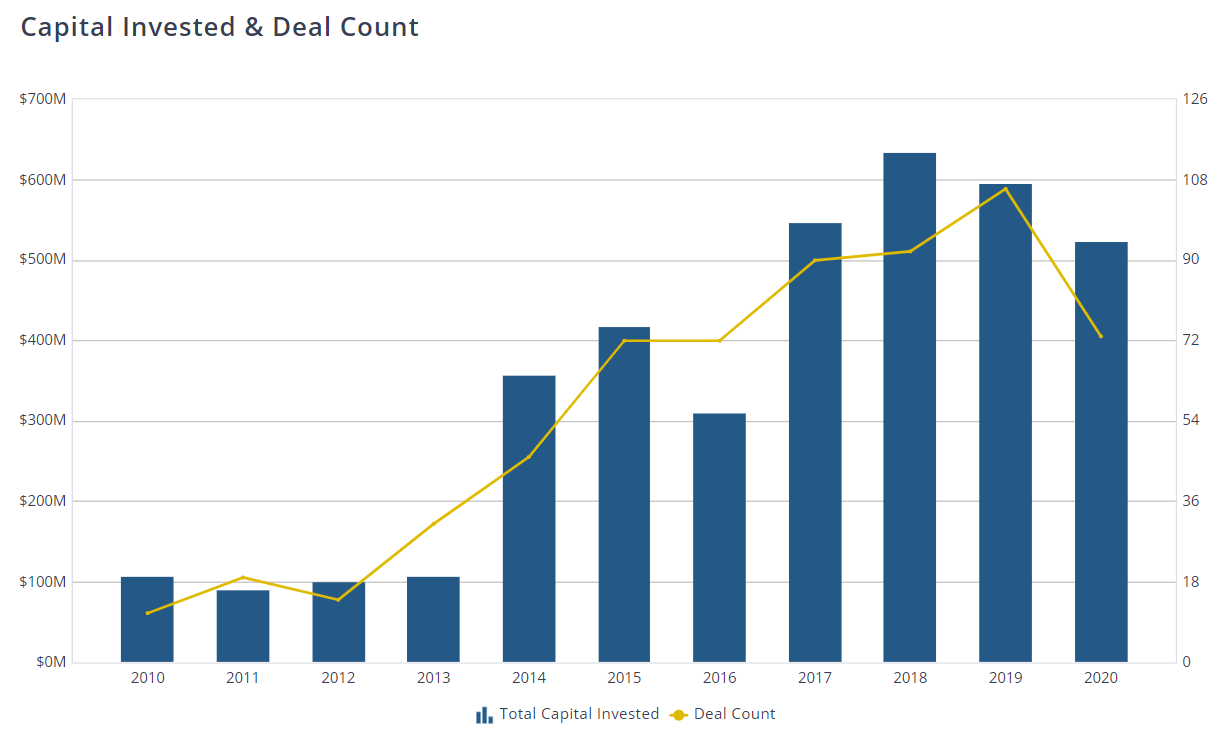

Ten years ago, total funding to the global femtech sector did not even crack $70M. In 2018, the market raised a record-breaking $620M, but since then, total funding has declined. Unfortunately, 2020 isn’t shaping up to be any better. As of October 2020, femtech has raised approximately $520M, putting the year on pace with 2019.

The top 2020 femtech deals include Sera Prognostic’s $65M Series D round, Maven Clinic’s $45M Series C round, Care/of’s $40M Series C round (prior to the Bayer acquisition), TMRW Life Science’s $36M Series B round, and Kindbody’s $32M Series B round.

The top institutional investors in femtech are Arboretum Ventures, BoxGroup, Female Founders Fund, Founders Fund, Slow Ventures, and Union Square Ventures, all of whom have made eight or more investments in the last decade.

Recently, we’ve also seen more female investors raising funds exclusively focused on investing in women and women’s healthcare:

- Avestria Ventures invests in early stage women’s health and life sciences companies

- Portfolia invests in emerging technologies, products, and services that improve a woman’s health throughout her life. Astarte Ventures invests in companies that improve health outcomes for women and children. Female Founders Fund more broadly invests in brands that define the future of wellness

- HealthVenture is a global foundry and venture capital fund that incubates and invests in seed and early-stage digital health startups.

The existing femtech landscape can broadly be segmented into five categories:

- General healthcare and diagnostics: companies improving the overall experience of women’s healthcare, including diagnostic testing, disease treatment, genomics, and telehealth. Startups like Maven, Tia, and Advantia Health provide on-demand healthcare appointments to women, while others like iSono Health and Endoceutics are focused on developing treatments for conditions and diseases that disproportionately affect women, like uterine cancer and dyspareunia.

- Menstruation care: companies providing solutions to manage period care, including new types of tampons, pads, and period cups. Developments in this segment have largely focused on environmental sustainability and new kinds of products to manage menstruation. Startups like Blume and Cora offer organic and natural ingredient-based period subscription boxes, while Thinxsells absorbent underwear that allow women to forgo tampons or pads altogether.

- Fertility and reproduction: companies offering solutions for women trying to conceive, including period/ovulation tracking, In Vitro Fertilization (IVF), egg freezing and donation, and at-home monitoring devices. Startups in this segment are increasingly focused on providing greater convenience and optionality. For example, Modern Fertility sells a fertility hormone test that is delivered directly to consumers, while Ollipsis enables women to freeze their eggs for free, provided they donate 50% of their eggs to families struggling with infertility.

- Pregnancy, nursing, and maternity: companies helping mothers and medical professionals with pre and postnatal care, as well as nursing care. Solutions in this segment are focused on maternal education (June Motherhood), remote monitoring (BabyScripts, Owlet), analytics and testing to improve outcomes (Lucina, Sera Prognostics), and tech-enabled devices to ease nursing (Willow, Keriton).

- Sexual and pelvic health: companies providing greater access and solutions to gynecological care, contraception, sexual education, and sexual pleasure, including STD treatment, pelvic health, and menopausal care. Companies like Joylux and Elvie focus on pelvic floor training through innovative devices and serums, while others like Thermaband and Caria provide relief to menopausal women experiencing symptoms such as hot flashes and night sweats.

Key Trends and Drivers

- Expanding market: As of 2019, the global femtech market is estimated to be $820M — a tiny fraction of the broader spend on global healthcare. There remains significant opportunity to further grow and innovate in this sector, especially considering that women spend an estimated $500B annually on medical expenses, and make 80% of healthcare decisions in the US. Women are also better consumers of healthcare — they spend nearly 30% more per capita on healthcare than men, and are at least 75% more likely to use digital healthcare tools. As most of the funding in femtech has been overwhelmingly concentrated on fertility, I believe there is significant room for progress in more general areas like chronic disease management (around conditions like endometriosis and diabetes), diagnostics, and pain management.

- Convenience: one of the most important trends to come out of the femtech movement is a greater focus on accessibility and convenience. A 2017 Kaiser Women’s Health Survey found that nearly a quarter of US women did not receive care because they did not have time, and because they could not get out of work. Accordingly, many startups have explored new business models — from at-home testing kits to remote monitoring devices — to democratize access to healthcare, provide greater optionality, and better accommodate the needs and lifestyles of their customers. For instance, Hey Jane delivers abortion medication directly to patients’ homes, while Kindbody operates a series of mobile fertility clinics so women can get treatments in the most convenient locations.

- Affordability: many startups in the women’s healthcare industry are focused on providing more affordable, high quality care — often by taking advantage of tech-enabled models like telehealth. For example Maven appointments start at $18 for a 20-minute session with a nurse practitioner, which is less than the cost of most co-pays. Many startups also offer their services at a flat rate, providing greater transparency for both patients and providers. Nurx, a birth control delivery startup, sells contraception for as low as $0 with insurance, while Origin offers physical therapy and pelvic floor treatments for just $10 to $40 in out-of-pocket costs. Unfortunately, some services such as fertility treatments remain out of reach for most patients; but as the market matures, we should expect to see the cost of these treatments decline.

- Personalized medicine: the rising incidence of infectious and chronic diseases among the broader population has led to a huge uptick in demand for more effective and personalized treatment. For women specifically, precision medicine has the potential to dismantle some of the inherent biases against women in healthcare. While we’ve known for years that women experience diseases differently than men, women remain underrepresented in research and treatment. As more gender-specific research is done, more will be uncovered about the biological processes and genetic markers that are linked to disease — which will hopefully lead to better outcomes. For example, precision medicine might enable medical professionals to better predict the age of menopause for a woman, so that treatments to prevent osteoporosis and cardiovascular diseases — which are more likely to occur after menopause — can be tailored the individual.

Looking Ahead: Exits

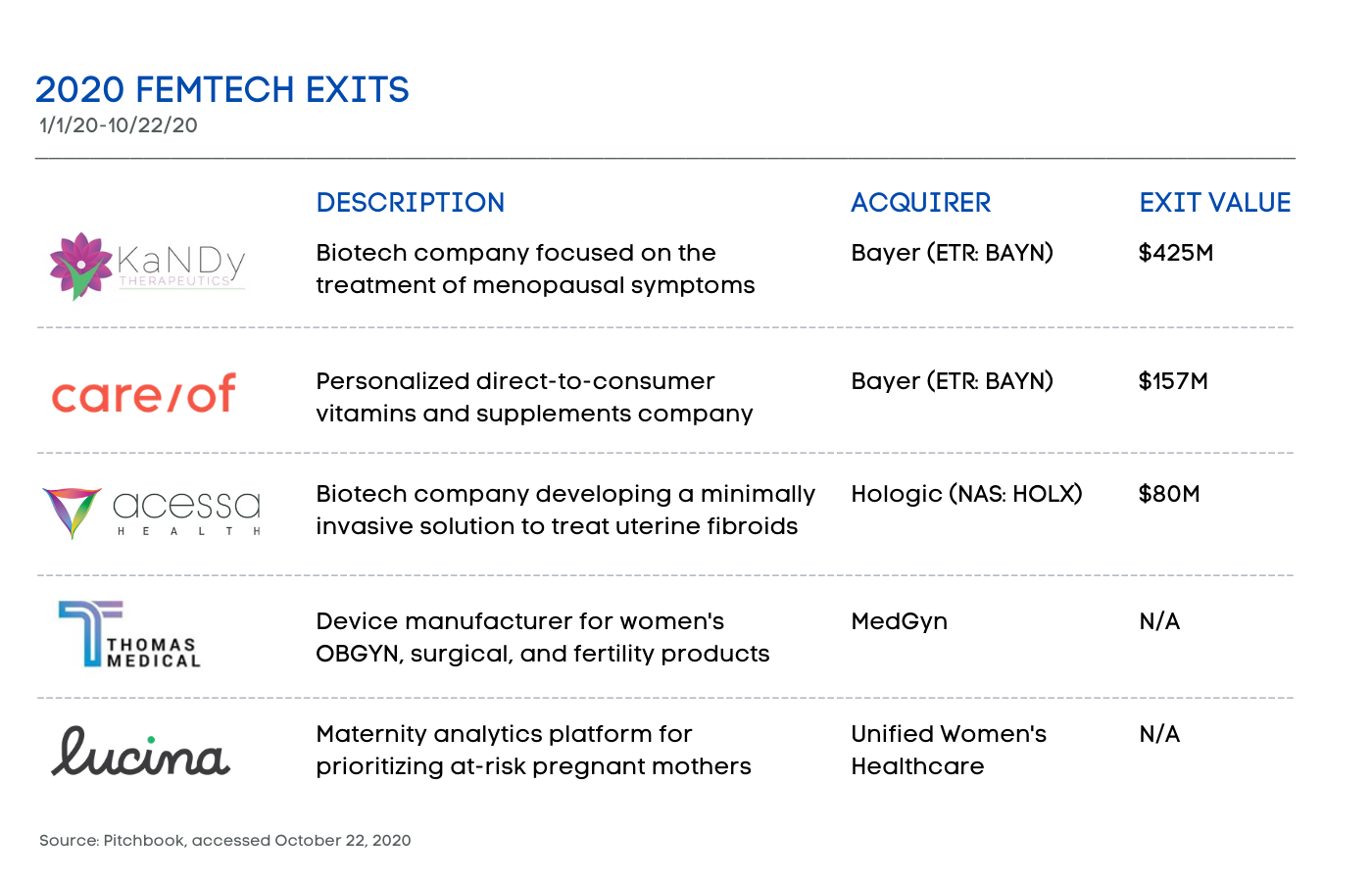

Existing women’s healthcare solutions are small pieces of a much larger, untapped market. Technology will continue to be a driving force in women’s healthcare, and investors that recognize these opportunities will stand to benefit from the millions of women that are seeking solutions for their conditions. While the industry suffers from a lack of exits today, I believe that we’ll continue to see more exits as the market matures, and as a greater number of investors wake up to the opportunity within femtech. Already, the six exits completed in 2019 represent a 64% increase in exit value relative to 2018. And Progyny (NASDAQ: PGNY), has seen a nearly 2x increase in its stock price since it went public, at a market cap of $2.4B today.

So far in 2020, we’ve seen five exits in the femtech space, with two companies acquired by Bayer (ETR: BYN), one of the largest pharmaceutical companies globally.

With the market heating up, I remain optimistic about the future of women’s healthcare. Stay tuned for Part II of this series, where I profile three founders powering the industry forward.

Source: https://thermaband.com/investing-in-femtech-the-case-for-womens-healthcare-part-i/